According to Giving USA’s June 2020 report, 2019 was a phenomenal year for fundraising. U.S. Nonprofits generated ~$450 billion through individual contributions making it one of the best years in history. There were high hopes in 2020, but no one saw what came next: a global pandemic, consumer uncertainty, a massive drop in economic output, and shelter-in-place orders that disrupted traditional business activities. Nonprofits had to adapt and pursue new ways to fundraise in the “new normal” that lacked events, travel, and traditional donor cultivation.

So the question is: what’s next for 2021?

Windfall works with 700+ nonprofits across the nation, ranging from local community organizations to major universities and hospitals. During 2020 we saw how many of these organizations adapted to this rapidly changing environment by embracing high-quality information to drive efficiencies to more effectively engage with existing constituents and uncover the next wave of philanthropic donors.

Last year, we wrote about our 2020 predictions and they largely came true, but maybe not for the reasons that we anticipated in January 2020. With our new year and nearly a quarter under our belt, Windfall has identified five trends in data & machine learning for nonprofits in 2021 that can help organizations continue to navigate this rapidly changing environment:

- Traditional Gift Capacity Metrics Are Being Replaced, Permanently

- Data Freshness Is the New Normal

- Fundraisers Will Continue to Double Down on Existing Constituents

- Data-Driven Development Will Become The Cornerstone Of Most Fundraising

- Artificial Intelligence Will Become Expansive In The Nonprofit Industry

Traditional Gift Capacity Metrics Are Being Replaced, Permanently

This was one of our predictions at the start of 2020 and we believe it will continue to accelerate in 2021. Organizations that continue to rely on traditional metrics, such as home values and prior giving, to influence gift capacity will find it harder than ever to identify constituents if they don’t adopt more robust strategies for evaluating gift capacity.

We still hear from industry veterans that historical giving is the largest indicator of measuring gift capacity. This data is becoming increasingly challenging to find given the rise of Donor Advised Funds (“DAFs”).

These same veterans come to Windfall and regularly ask: can you help us find individuals who contribute through a DAF? How much did they give?

In 2019, almost 13% of individual contributions were made to DAFs, according to the National Philanthropic Trust. The assets held by these funds continue to grow at a dramatic rate making it difficult to rely on historical sources of data. There are three issues associated with DAFs for data-driven nonprofit professionals: (1) you do not know if an individual is philanthropic and (2) it’s hard to determine what causes they contribute to, assuming they do, and (3) it’s unclear how to identify individuals that have a DAF.

Good news for nonprofits: The assets held in DAFs are starting to be deployed at higher rates. In 2020, the floodgates of grants from DAFs opened in response to the tremendous suffering caused by the pandemic. The first six months of 2020 saw a 29.8% increase in DAF grants to charitable organizations compared to the same period in 2019. If you only look at the volume of individual grants from DAFs, there was a 37.4% increase for the same period.

If historical gifts aren’t reliable predictors of future giving (or not readily available), what about other wealth indicators like home value? There are many issues with this approach as well:

- Geographic implications: Are you considering regional differences? Median home prices in San Francisco will be different than Santa Fe; even within a state Albany, NY looks different than NYC

- Property data: Do you have the right property valuation? Is it up to date? Keeping up with the fluctuations in every market for multi-property owners is really hard

- Equity vs. debt: If you live in a $2MM property, does that mean you have a significant amount of wealth? Well that depends on how much debt is on the property, when you purchased it, etc.

When organizations first approach us, they always ask us if we can reduce the reliance on real estate for the issues we listed out above. Windfall provides precise net worth estimates versus traditional gift capacity metrics. Thus, we actually take into consideration all of the issues that development professionals face and refresh the data weekly to keep records up to date.

Major Gift Officers are constantly asking: how do we make sure HNW prospects don’t fall through the cracks? Given this focus and the maturation of wealth data, data-driven development professionals will replace traditional gift capacity metrics, permanently.

Data Freshness Is the New Normal

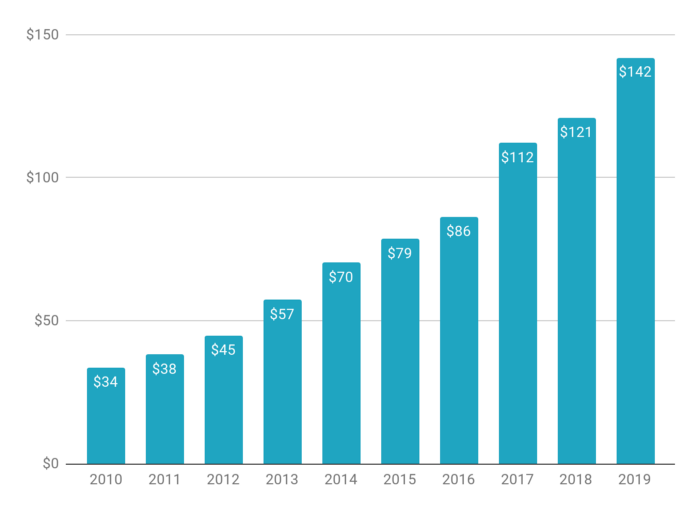

As with 2020, this remains a top trend for 2021, supported by our own customer usage data. For many, 2020 felt like a tectonic shift in society happened every couple of weeks. If you were wealth screening your database in January 2020, the world looked completely different in April 2020. As the economy started to recover though, November 2020 looked significantly different from April 2020. Why is that?

There certainly was a shock to the system as the US economy locked down quickly in mid-March and April. During the same time period, we began to see the wealth gap increase:

13.3% more affluent ($1MM+ net worth) households

17.7% increase in total wealth held by high net worth households

67% of total US wealth held by high net worth households

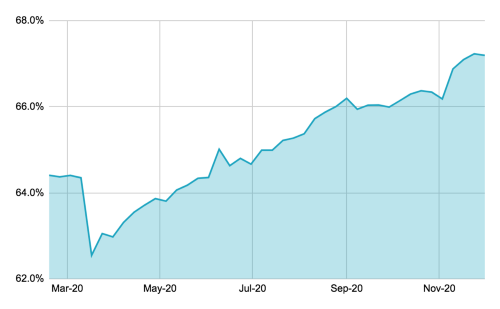

When Windfall was founded in 2016, many nonprofits told us that screening every 3 years was the norm and that they only selected a handful of records to screen. Looking at just the past year, this now seems like a crazy statement given the extreme volatility and fluid nature of people, wealth, and philanthropic capacity.

Windfall wanted to understand how our customers have adapted to this new world. We looked at a cohort of our customers, accounts that were with us in Q3 2019 and active throughout 2020, and measured if they screened with us (updated their data) in a given quarter. We’ve highlighted a few key trends / insights:

- Windfall saw and upward shift in screening cadence prior to the pandemic hitting in 2020

- There was a spike in Q1 ’20 (mostly in March)

- Screening cadence declined slightly from its peak in Q1 2020, but the change in behavior seems permanent: ~88% of accounts synced with us in Q2 2020

Without fresh data, our customers could be blind to someone who had a wealth creation event 90 days later that may have had the potential for a massive donation. They will certainly be years behind in their efforts to identify wealthy millennial constituents who, only months ago, appeared to have no capacity for gift giving and have no gift history. A recent survey conducted by Fidelity Charitable showed millennials give more than twice as much of their money and time to charitable causes as Baby Boomers and Gen X. Data decay, or working off of stale data, has always been a real problem, but in 2021 working off of data from three years ago, or even one year ago will be like trying to use a phonebook for the wrong city.

Windfall updates its data each week and makes our updates available to all customers no matter the size of the contract. We believe that this is incredibly important not only for helping identify the right prospects and donors, but has downstream implications for:

- Segmentation

- Donor insights

- Predictive modeling

As we look to an unknown recovery or relapse in 2021 and beyond, the organizations that gravitate towards data freshness will be more successful than their counterparts.

Interested in learning more about how Windfall can help your organization?

Fundraisers Will Continue to Double Down on Existing Constituents

In 2020, we thought that fundraisers would focus more on existing constituents. Well, this prediction was 100% correct, although not for the reasons we highlighted. Once we found ourselves facing a world without physical events, travel, and traditional networking, fundraising teams needed to take a different approach. In 2020, we hosted several roundtables to help our customers understand the multitude of strategies:

- Windfall Customer Roundtable Insights: Development Strategies During COVID-19

- Windfall Customer Insights: Data Driven Development for Independent Schools

- Alpha Tau Omega’s Journey to Data-Driven Development

Researching your constituents with fresh data can be like turning on a light switch in a dark room after stumbling around in the dark. It can reveal constituents with great capacity that already have an affinity for your organization (since they’ve already made it in your CRM or other systems of record).

One of our favorite stories is from Make-A-Wish Arizona, who leveraged Windfall to cultivate mid-level giving after their annual gala was canceled due to COVID-19 restrictions. By harnessing wealth intelligence, the team was able to craft a strategy to steward and develop relationships that led to increases in annual contributions. By June 2020, despite not having their flagship fundraising event, Make-A-Wish Arizona was able to meet their annual goal!

Windfall improved its analytics and insights suite, which we offer for free to nonprofits, to help evaluate where there may be under-penetrated opportunities within their constituent base. One example includes looking at existing donors and understanding trends in order to formulate strategy:

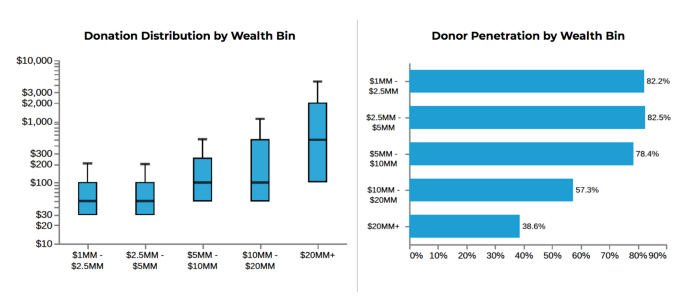

In the analysis above, the nonprofit can glean several actionable insights:

- Net worth is correlated with increasing gift levels

- Median donation amounts (black line) are fairly similar for $1MM — $5MM and $5MM — $20MM; there is an opportunity to dig in further to these cohorts

- While $20MM+ net worth donors are giving more, we can see they have the lowest penetration of any group based on the graph on the right

As organizations start looking inwards for growth, they can start answering strategic questions:

- Is this a qualified constituent for my major gift officers?

- Can I cultivate these gifts into much larger ones in the future?

- Have I spent time stewarding the right individuals?

- Which individuals should I spend more time with?

For example, The New School began screening 270,000 records on a monthly basis with Windfall late in 2019 through our partner EverTrue. Over time, they identified 30,000 incremental HNW prospects for their MGO team. This effort kept the team extremely busy throughout 2020 as the team was able to replenish their pipeline to meet fundraising goals.

Data-Driven Development Will Become The Cornerstone Of Most Fundraising

This is a new key trend for 2021 that revealed itself as an essential approach for organizations that could no longer rely on their traditional approaches to fundraising during the pandemic. Many of our customers have asked us for advice on how to become more data-driven, and are still thirsting for approaches to handle organizational change. In order to help simplify this for our customers, we offered this simple framework:

- Establish a foundation of trustworthy data

- Develop meaningful insights into your constituents

- Generate deeper intelligence from your data

- Take action on your data across the organization

- Analyze, measure results, and iterate

The COVID-19 pandemic has changed the way fundraisers cultivate relationships and steward their constituent base. Even though the whole world feels like it is just a couple clicks away via Zoom meetings, the historical ways of fundraising and developing relationships seem like foreign concepts. Of course, time is still limited and determining how to allocate your time (your most valuable resource) appropriately is key for all data-driven organizations.

There are many creative forms of digital donor engagement that nonprofits effectively employed over the last year including: virtual meetings, personalized videos, emails, text messages, or even physical gifts through direct mail. All of these options can be effective and valuable, but they still take time, resources, and increasingly scarce creative energy to ensure your organization stands out. How do you make sure that you’re sending those personalized messages to the right segment of constituents and spending scarce resources in a way that yields a high return on investment?

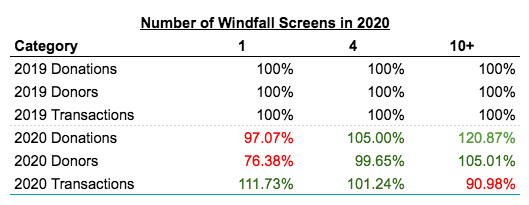

Circling back to our second theme around Data Freshness, the most effective way to truly create a data-driven culture is to ensure that your team is analyzing, measuring and iterating. At Windfall we took a look at a few groupings of our customers, using screen frequency as a measure of Data Freshness. We looked at: those that leveraged our data one time, four times, and ten or more times during the year regardless of when they started with Windfall. It was incredible to see some of the fundraising results bear out comparatively.

Does syncing with Windfall automatically result in higher donations? Correlation and causation are certainly two different things. The organizations that sync more frequently and use the data in workflows are more prone to highlight the hidden gems, steward the right constituents, and ultimately spend time in the right places.

A perfect example is what the team is doing at NYU. The team put together a simple 2×2 matrix to make data actionable and build trust throughout the major giving team:

By leveraging this approach, NYU is able to make Windfall’s data actionable and iterate on the approach as they continue to measure results and double down on success.

Uncertainty and volatility in the markets remain in 2021, and we anticipate that the trend we observed last year is here to stay. As a byproduct, it has accelerated the adoption of certain data approaches much more quickly than the overall industry expected. This includes artificial intelligence and machine learning.

Artificial Intelligence Will Become Expansive In The Nonprofit Industry

At the start of 2020, we predicted that artificial intelligence (“AI”) would become democratized in the nonprofit industry, but for 2021 we believe the evolutionary trend we’ll see is that it will not only become more expansive but also better understood. The amount of understanding and appreciation for various data science techniques is faster than Windfall ever anticipated.

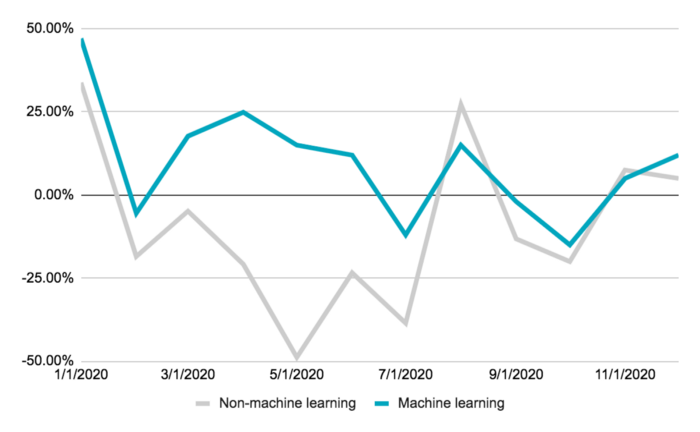

Although still nascent in its adoption, artificial intelligence and machine learning are here to stay for nonprofit fundraisers. The benefits of using data science to help you find more constituents that align with your organization’s long-term mission are just too hard to ignore. The industry professionals who lean into AI and learn to effectively implement it will be the ones who help usher in a new era of efficiency in the industry. As an example, we analyzed those customers who implemented machine learning algorithms with Windfall versus those that did not and the results are pretty staggering:

While the organizations experienced similar trends throughout the year, those that embraced machine learning were able to spend time in the right places and experience a much less negative impact on annual fundraising. In fact, all of our customers who implemented our propensity to give product in their workflows in 2019 saw individual contributions increase in 2020.

As your organization begins to evaluate vendors to help execute these strategies it will be important to ask them the right questions. If two vendors are both showcasing their propensity models that both generate seemingly similar scores for predicting gift capacity, how do you determine which one is more accurate?

To answer that, you’ll need to understand what went into that propensity model. How are the algorithms evaluating the inputs? What level of proprietary third party data attributes and feature engineering are made available to drive model performance? What are the costs and benefits associated with that method? Are they using all available first party data? How?

It’s also important to understand the nature of the development of the vendors’ models. Is the vendor a traditional services organization that bolted on an AI-solution into their core offering? Or does the vendor specialize in data science and advanced propensity model techniques that are truly a cut above the rest of the offerings out there? What is the ongoing cost of these solutions? Is the vendor providing a one-time “score-dump”, or an iterative loop of true machine learning and model retraining?

Data science techniques are not a silver bullet though, they require investment from stakeholders to seek adoption and iterate. At Windfall, the implementation and onboarding process doesn’t stop once we deliver scores to our customers, but we work with them to strategically deploy these scores so that teams can gain feedback, confidence, and results from our advanced propensity models.

Conclusion

2020 created challenges for many industries. In our post from last year, we had five key themes that we predicted would be critical for nonprofits and found that many of them came true. The pandemic has accelerated the need for organizations to rethink their playbooks and become more data-driven on a consistent basis.

We are encouraged by the 700+ nonprofits we currently work with every day to help us drive this innovation further. To find out more about our services and how we may be able to help your organization, contact our customer success team that is focused on helping nonprofits thrive.

The analysis and article were co-authored by Arup Banerjee, CEO and Co-founder, Jeff Kamei, Director of Engineering, and Harry Morton, Data and Operations Analyst, using a combination of third-party research, internal research, and Windfall’s proprietary data.